Amazon has made it easy for independent sellers to launch an eCommerce store and connect with Amazon’s massive customer base, and many sellers are raking in big profits. Few things are as exciting as watching a business you’ve started succeed and grow, but maintaining that success requires attention to some not-so-exciting details—like paying the taxes on your sales revenue.

Third-party Amazon sellers in the U.S. have an average annual sales revenue of over $230,000. That’s great news for eCommerce entrepreneurs, but that revenue comes with tax implications that can’t be ignored. The penalties for evading taxes or submitting late payments can be harsh, so staying on top of this essential administrative responsibility is crucial.

What makes things complicated is that there are multiple tax obligations to keep track of—sales tax, state and federal income tax, VAT, and even business property taxes in some cases. While there’s no substitute for guidance from a tax professional, we’ve got you covered with a breakdown of your potential tax obligations as an Amazon seller and how to determine them.

What are the basics of Amazon seller taxes?

The taxes you’ll be liable for as an Amazon seller will depend on your business location, what sorts of products you’re selling, and the amount of your earnings.

You’re likely to be required to file and pay the following taxes:

- Sales tax

- Federal (U.S.) income tax

- State (U.S.) income tax

- International taxes, such as Value-Added Tax (VAT)

- Business property taxes

Ultimately, if you’ve made significant sales on Amazon, you’ll owe taxes to someone. The next step is determining what kind of taxes are owed and to whom.

How does sales tax work for Amazon sellers?

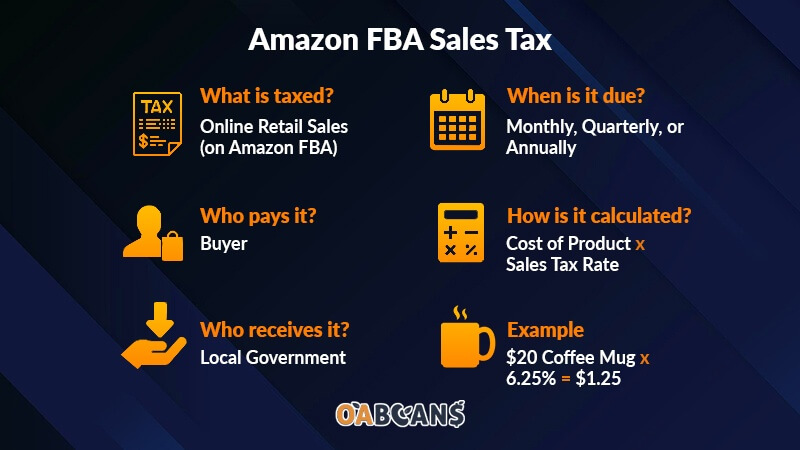

In many cases, Amazon must handle sales taxes on behalf of its third-party sellers. However, in some situations, the seller is obligated to do their own reporting.

Some U.S. states have Marketplace Facilitator laws obligating platforms that host third-party sellers, like Amazon, to collect and remit sales taxes on purchases made in those states. Most states have these laws on the books; a few of them—Alaska, Delaware, New Hampshire, Montana, and Oregon—don’t have sales taxes at all.

If you’re selling in states with sales taxes but no Marketplace Facilitator legislation, it’s your responsibility to ensure the sales taxes are handled correctly.

Understanding the Sales Tax Nexus

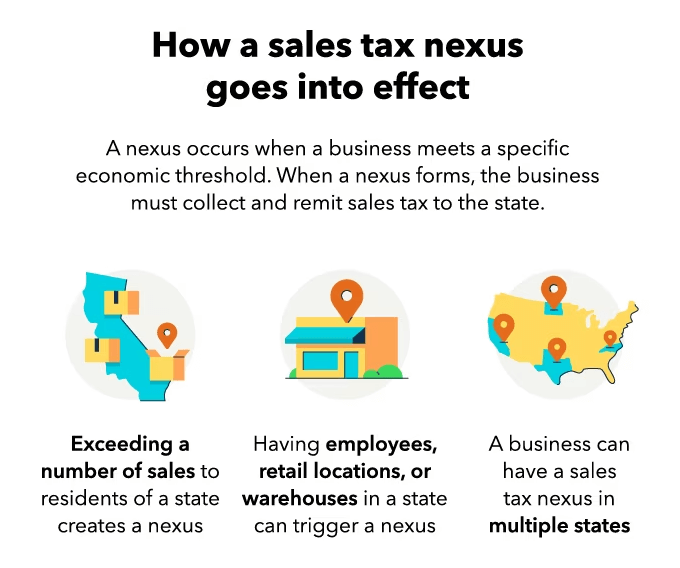

The first thing to do is determine whether a sales tax nexus exists. A sales nexus signifies that your business has a significant enough presence in a state that you must collect and pay sales taxes. A nexus may be established by exceeding a certain threshold of sales to customers within a state or by having employees, retail stores, or warehouses within the state.

Unfortunately, there’s no blanket set of regulations on what criteria determine a sales tax nexus, so you’ll have to review the laws of each U.S. state in which you do business. The number of states you can have a sales tax nexus is unlimited.

How to Collect Sales Tax on Amazon

The next step is to apply for a sales tax permit with the state(s) in which you have a nexus. Before you can collect sales taxes, this is a requirement, and it will come with instructions about when and how to file.

After that’s complete, all you need to do is set up the collection of sales tax in Seller Central. From there, you can enter state and product information, enabling Amazon to automatically charge the correct sales tax amounts on taxable purchases.

Factors to Consider When Collecting Sales Tax

It’s critical to do your research and understand the sales thresholds for establishing a sales nexus in any given state. You’ll need to keep track of sales and update your permits and Seller Central configuration as soon as those thresholds are met.

Not all products or purchases are taxable, so make sure your tax codes are set up correctly for exempt items. If you’re reselling to other merchants, your sales may not be taxable at all.

What are the tax obligations for Fulfillment by Amazon (FBA) sellers?

A key point to understand when using Amazon FBA is that it establishes a sales tax nexus for you in any state that hosts an Amazon warehouse or corporate office.

Currently, Amazon has a presence in 48 states and territories. You can check your seller account to see where your products are being warehoused. If Amazon’s presence in a state creates a sales nexus for you, you’ll need to follow the steps above, starting with obtaining a sales tax permit.

Each state determines sales tax filing and payment frequencies and can vary based on your sales volume. States typically require monthly, quarterly, or annual filings. Higher-volume sellers are usually required to file more frequently.

What federal income tax considerations should Amazon sellers keep in mind?

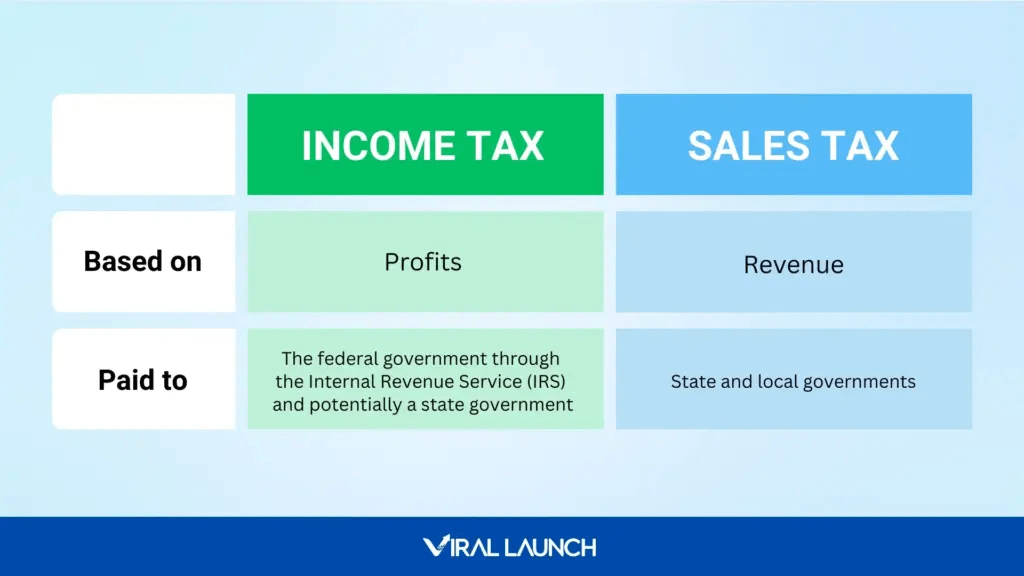

Unlike sales tax, which is based on sales revenue and charged to the customer at purchase, income tax comes from the seller’s profits. The income you make from your Amazon business in the U.S. will be considered taxable by the Internal Revenue Service (IRS) and must be included in your annual filings. Your income may also be taxable by your home U.S. state if it has an income tax. Amazon doesn’t automatically withhold income taxes for you.

In most cases, all of your gross annual income is taxable—that means not just the price customers paid for the product, but also the associated costs like shipping. The good news is that you can offset your tax liability by deducting your business expenses.

What deductions and credits are available for Amazon sellers?

Expenses directly related to your business’s operation can be deducted when you file Federal Income Taxes.

Here are some typical write-offs for Amazon sellers:

- Amazon fees

- Cost of goods sold (parts, labor, production, wholesale products, etc.)

- Advertising expenses

- Travel costs, including mileage

- Software tools that support your Amazon business (like Noogata)

- Fees paid for business-related consultation, education, training, and services

- Space and equipment needed to maintain a home office

- Wages and benefits paid to employees

- Charitable donations (of money or products)

Be sure to keep receipts for these expenses in case you get audited. If you’re not sure if you can legally deduct something, check with a tax professional.

How does Value-Added Tax (VAT) impact Amazon seller taxes?

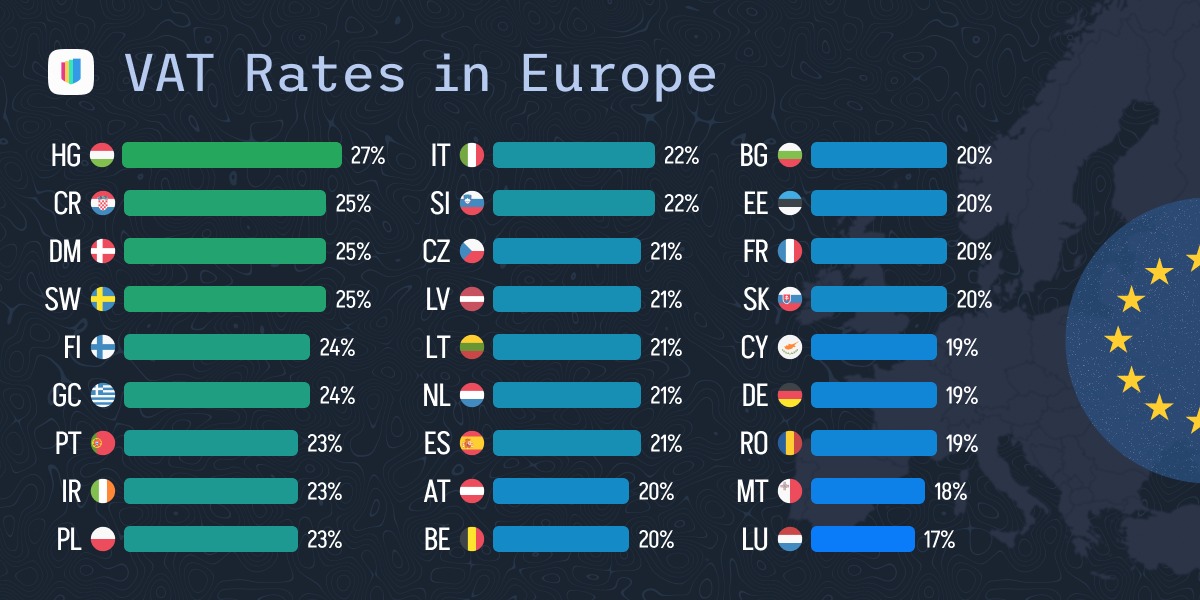

Certain additional taxes may apply when you sell to international customers. Many European countries, for instance, charge VAT. Like sales taxes, these are paid by the customer, but it’s the seller’s responsibility to collect and remit them.

For all EU member states, the annual sales threshold at which sellers must start collecting VAT is €10,000. If you expect to exceed this threshold or have significant sales to international customers outside of the EU, consult a tax professional about the proper handling of it

Are Amazon sellers liable for business property taxes?

In some jurisdictions, registered businesses may be required to report the value of the equipment and fixtures used in their business operations and pay property taxes. If your only equipment as an Amazon seller is a personal computer, these taxes may be negligible or excused entirely. Check with your local tax assessor’s office to ensure you aren’t caught off-guard by non-filing penalties or unexpected property tax bills.

What are the essential forms for Amazon seller tax reporting and filing?

If you have over $20,000 in sales and 200 transactions within the year, Amazon will provide you and the IRS with a 1099-K form summarizing your gross sales, sales tax collections, and shipping fees. You can download this form from Seller Central under the “Reports” menu. It’s also a good idea to run your own sales reports and check your 1099-K for accuracy.

If you have more than 50 transactions yearly, Amazon will require you to provide your tax information, even if you don’t otherwise qualify for a 1099-K.

When you file, you must report your Amazon income on Schedule C of Form 1040. If you expect to owe over $1,000 in taxes at the end of the year, you’ll also be required to make quarterly estimated payments.

How can Amazon sellers file taxes?

When it’s time to prepare and file income taxes, you have three options:

- Doing it yourself

- Hiring a tax professional

- Using tax software

Doing it yourself has the advantage of being zero-cost, but if you have a complicated tax situation and many potential deductions, a tax professional can provide the greatest degree of accuracy and peace of mind. As a compromise solution, tax software can offer an affordable filing solution that includes online assistance and audit protection.

Consider reviewing Amazon’s income tax reporting resources to get the latest Amazon seller tax information before you file, especially if you’re preparing the forms yourself.

The Silver Lining to Paying Taxes

Staying in compliance with tax law is absolutely essential for any business. It might feel like giving hard-earned money away, but think of it this way: A large tax obligation is a good problem to have because it means your Amazon business is growing and bringing in lots of revenue.

If you’re ready for your Amazon store to launch your income into a new tax bracket, Noogata’s AI-powered insights and competitive intelligence tools might be what you need. Offering features designed to boost your Amazon sales, including advanced analytics and an AI Amazon Assistant, it’s ideal for sellers managing large product portfolios ready to outperform the competition.

Try a free demo to discover how Noogata helps you conquer Amazon’s digital shelf.