The world of eCommerce is a battlefield, and two titans stand above the rest. It’s Walmart Marketplace vs. Amazon—and for digital brands, navigating this competitive landscape can feel like picking sides in a kaiju showdown. Who do you choose, Godzilla or King Kong?

Selecting the right eCommerce platform is critical for reaching your target audience and maximizing sales. However, the decision can be daunting, with Amazon and Walmart Marketplace boasting massive customer bases and robust fulfillment solutions. Many sellers will go the tried-and-true route of Amazon, the world’s top online marketplace—but here’s the kicker: ignoring Walmart Marketplace altogether could be a costly mistake.

A September 2023 study revealed that Walmart Marketplace doubled in size over the previous 18 months and now boasts over 150,000 active sellers. This explosive growth signifies a massive opportunity for digital brands to tap into a new wave of eager customers. With the global e-commerce market booming towards a record $3.2 trillion in 2024, you’ll want to ensure your products are in the perfect marketplace for optimal sales.

Let’s explore the strengths and weaknesses of each platform to help you decide which one reigns supreme for your digital brand.

Walmart Marketplace: A Rising Powerhouse

Since 2019, Walmart Marketplace has emerged as an eCommerce powerhouse from the chain of brick-and-mortar retail stores that began in Arkansas, USA, in 1962.

However, the 4,616 US physical stores are essential to its eCommerce operations. The vast store network provides a unique omnichannel experience for sellers and customers, allowing for supply chain features like distribution and delivery, as well as in-store pickup and returns. Globally, Walmart operates over 10,500 stores (of various brands) and numerous eCommerce websites in 19 countries, potentially expanding your brand’s visibility.

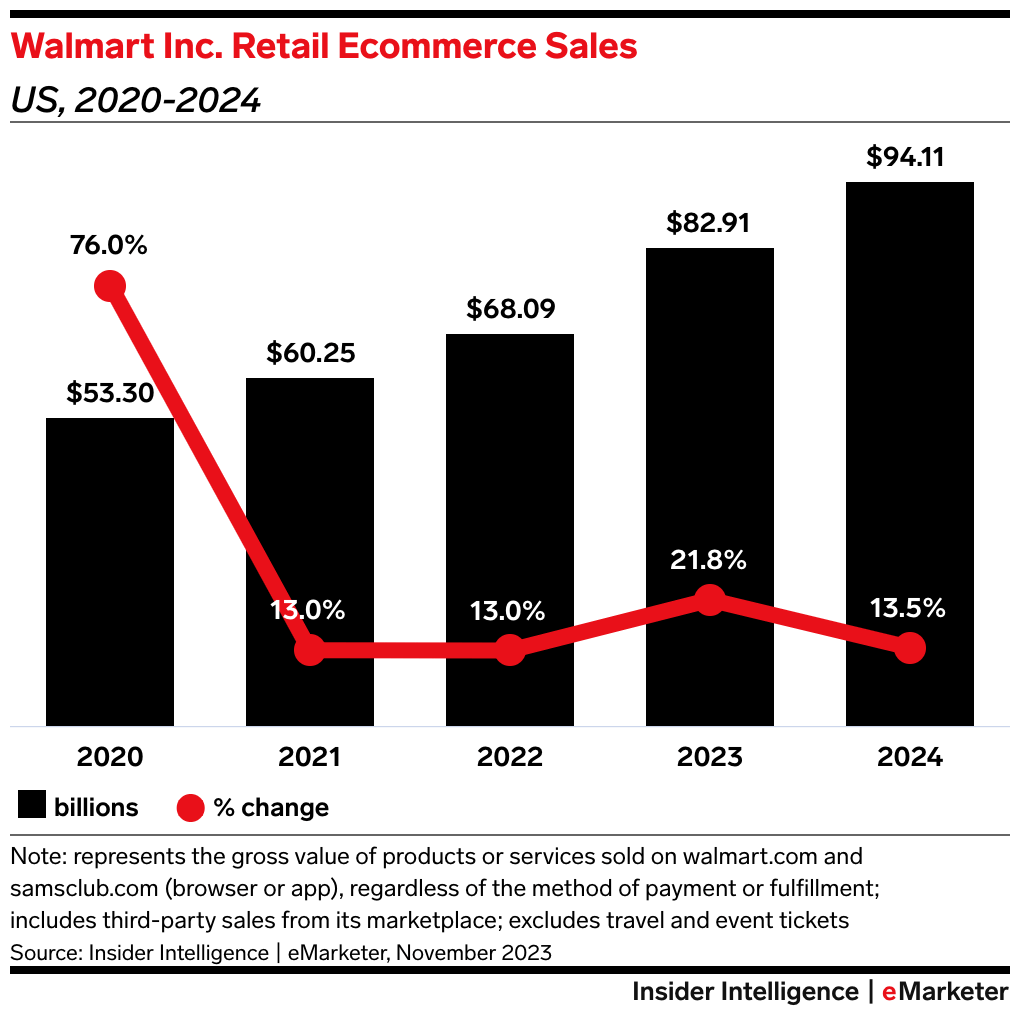

While dwarfed by Amazon’s overall sales figures, Walmart Marketplace boasts impressive annual sales exceeding $80 billion, which is over 13% of Walmart’s total revenue of $600 billion.

In 2023, it held a 6.4% market share of U.S. eCommerce, placing it #2 behind Amazon. Among the orders placed from the marketplace’s 150k-plus third-party sellers, 40% are from SMEs.

There’s good news for digital CPG brands, too. Walmart’s grocery eCommerce sales have boomed since 2020 and are expected to account for 26.9% of U.S. grocery eCommerce sales in 2024, amounting to $58.92 billion.

Looking for abundant traffic and a wide product selection? The Walmart Marketplace has them, averaging 120 million monthly visitors seeking just the right item among roughly 60 million listed products in 35 categories.

What are these numbers telling us? For digital brands looking to scale and tap into a loyal (and growing) customer base, Walmart Marketplace presents a compelling opportunity for significant business growth. However, in terms of overall size and reach, Godzilla is still behind the ever-formidable King Kong.

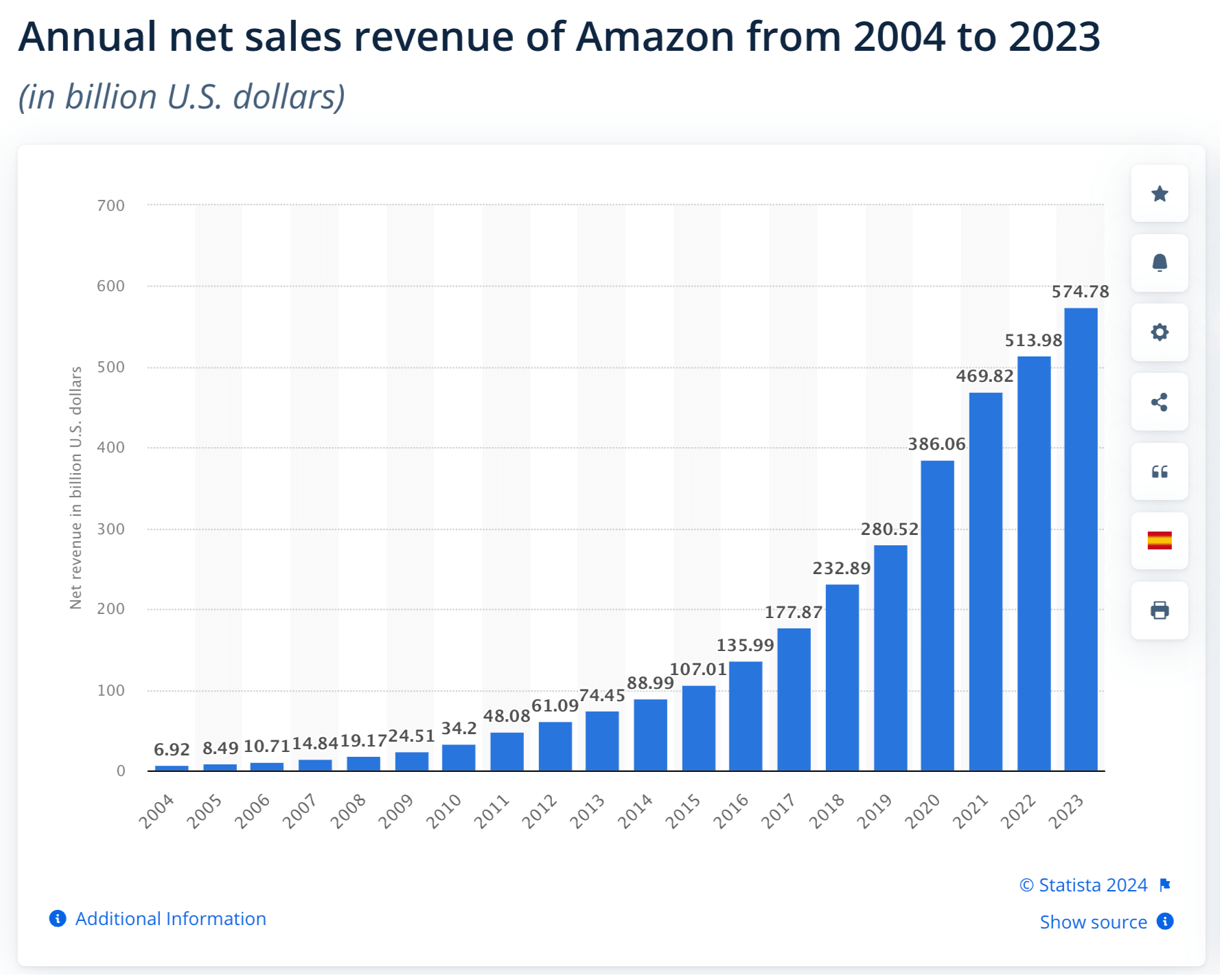

Amazon: It’s Good to Be King

Amazon.com remains the undisputed king of online retail, boasting a staggering annual 2023 revenue exceeding $574 billion—an 11.83% increase from 2022. This translates to a massive marketplace teeming with over six million active sellers globally, offering a mind-boggling selection of over 350 million products. No wonder Amazon had a 37.6% market share of U.S. eCommerce in 2023.

While Amazon itself sells a significant portion of the products listed, third-party sellers are responsible for over 60% of Amazon’s sales, and most of them are SMEs. Who’s buying? Over 300 million customers worldwide make two billion site visits per month.

Like Walmart, Amazon’s reach extends beyond the internet. With a network of 450-500 physical stores, including Amazon Go, Amazon Fresh, and Whole Foods stores, there’s potential for in-store sales, returns, and customer pickups. There’s also expanded visibility for digital CPG brands with online grocery sales forecast to hit $41.2 billion USD in 2024.

Amazon also has a truly global presence with 19 international marketplaces scattered across North America, South America, Europe, Asia, and Australia. This allows digital brands to tap into a vast international customer base and expand their reach exponentially.

These factors make Amazon an undeniably attractive platform for digital brands seeking significant sales opportunities and brand exposure.

Walmart Marketplace vs Amazon: Category Showdown

Now that we’ve explored Walmart Marketplace and Amazon’s landscapes, let’s compare them across crucial seller categories.

Seller Requirements

To sell professionally online, you usually need an account, certain documents, and specific government and tax I.D. numbers.

- Walmart Marketplace – Getting started on Walmart Marketplace used to be challenging, with an application process with strict criteria. In 2022, the process was simplified, and with the floodgates open to more sellers, numbers have increased rapidly.

- Amazon – Opening an Amazon seller account is a relatively straightforward process with few barriers to entry.

Verdict: Tie. Walmart Marketplace’s changes have matched Amazon’s ease of entry, which is convenient for digital brands who want to list their products on both.

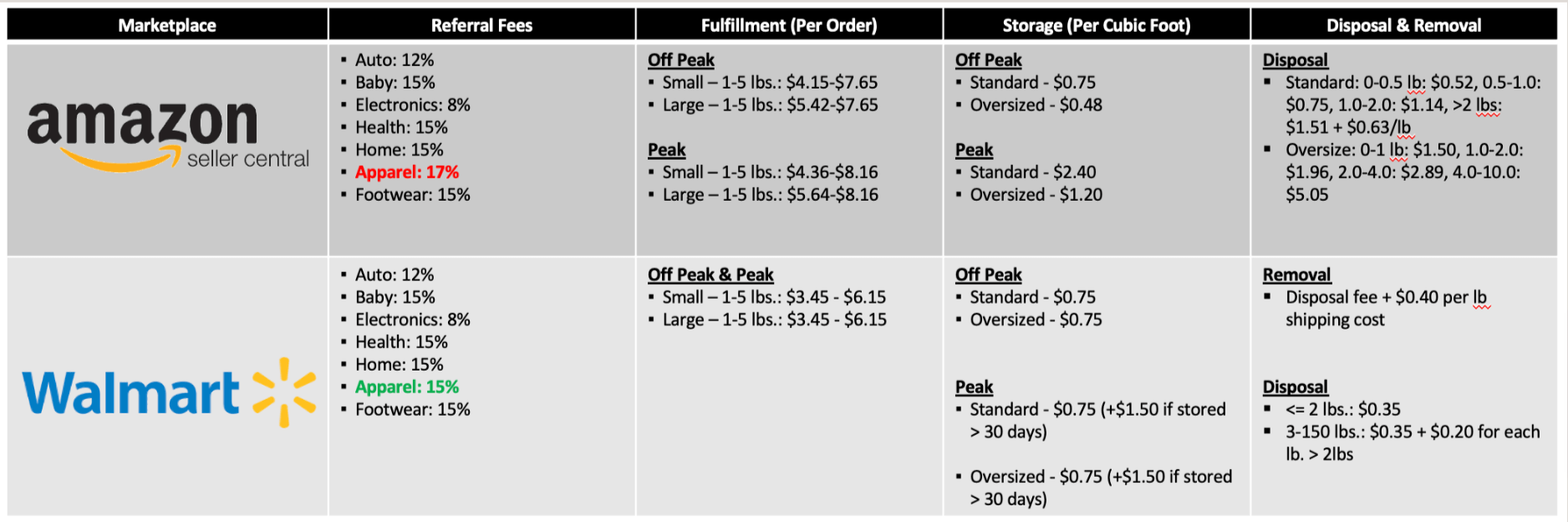

Seller Fees

Nobody sells for free. Digital brands seeking cost-effectiveness must be aware of the various fees they’ll encounter on each platform.

- Walmart Marketplace – Walmart’s fee structure is more straightforward than Amazon’s. They typically charge a referral fee per item sold, with some additional per-unit fees for specific categories.

- Amazon Marketplace – Amazon’s fee structure is more complex than Walmart’s. First, you must choose a selling plan:

- Individual Selling Plan: Ideal for sellers with a smaller volume of products (less than 40 per month), you pay a per-item fee of $0.99 for each sale.

- Professional Selling Plan: Catering to sellers with higher sales volume, a monthly fee of $39.99 lets you list an unlimited number of products.

Then, depending on the product category and fulfillment method chosen, you may be subject to a dizzying array of charges such as closing fees, referral fees, variable closing fees, and fulfillment fees.

Verdict: Walmart wins for simplicity and lower overall costs. However, for high-volume sellers, Amazon’s Professional Selling Plan and fulfillment options may offer cost savings.

Walmart Seller Center vs Amazon Seller Central

In this category, we’re looking at functionality and analytics/reporting.

- Walmart Seller Center – Walmart Seller Center is a functional platform for managing listings, inventory, and orders. It offers basic sales data and reporting tools. However, it lacks some of the advanced features and analytics tools Amazon Seller Central provides.

- Amazon Seller Central – Amazon Seller Central is a comprehensive platform with many tools for managing your business, including keyword research, advertising campaign management and metrics, detailed sales data, and customer behavior insights.

Verdict: Amazon wins. Walmart Seller Center is sufficient for basic needs, but Amazon Seller Central offers more advanced features, sophisticated analytics, and reporting tools. If you’re a digital brand selling on either—or both—marketplaces, integrating your seller platform with Noogata provides powerful AI-powered insights and optimization recommendations to maximize your advertising spend and product visibility.

Walmart+ vs Amazon Prime

Being a seller badged by either platform’s customer membership program can have a profound impact on your sales.

- Walmart+ – While not as established as Prime, Walmart+ has a rapidly growing membership base. Early data suggests Walmart+ members might be less swayed by price compared to Prime shoppers. This could allow for potentially higher margins on your products, as shoppers might be more willing to pay a slight premium for the convenience of fast, free shipping offered by your Walmart+ listings.

- Amazon Prime – Prime boasts a massive subscriber base, and that base is more likely to purchase Prime-badged products. Prime members are known to spend more frequently and in larger quantities compared to regular Amazon shoppers. Additionally, annual Prime Day sales offer opportunities for sales surges and brand exposure outside of the traditional holiday shopping rush. In total, being a Prime seller is almost a lock to boost your overall sales volume.

Verdict: Amazon Prime wins due to its larger, more established membership program with special sale days. However, Walmart+ offers sellers an opportunity to reach a growing and potentially less price-sensitive customer base.

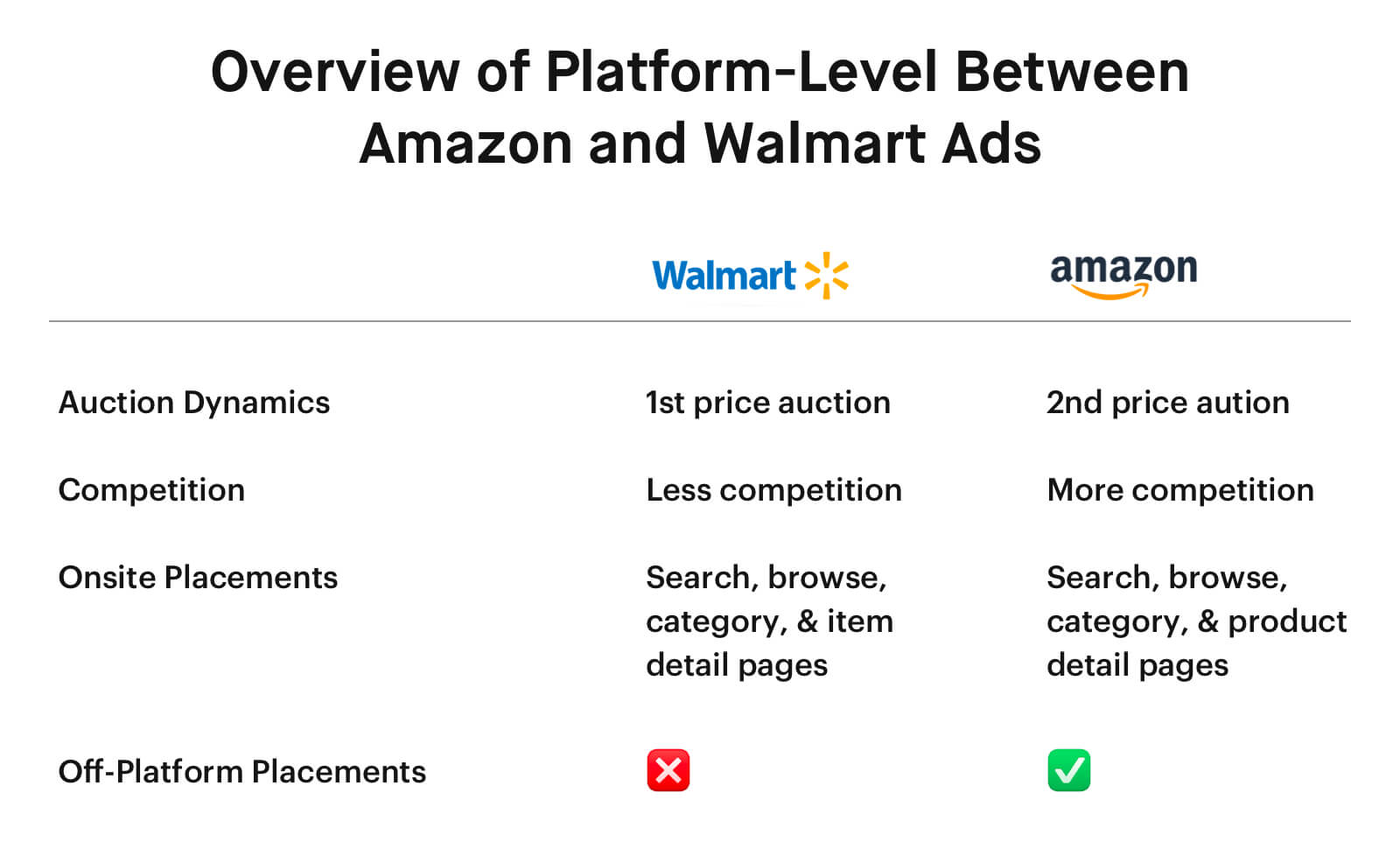

Advertising and Branding Options

Paid advertising is a difference-maker in standing out in a competitive marketplace.

- Walmart Marketplace – Walmart’s advertising options are still evolving, but they offer Sponsored Search and Display ads. Unfortunately, their targeting options are also more limited than those of Amazon.

- Amazon Marketplace – Amazon Advertising offers a robust suite of advertising placements, including Sponsored Products, Sponsored Brands, and Sponsored Display ads.

Verdict: Amazon wins due to the broader range of established advertising solutions. Walmart’s advertising options are growing. Noogata’s integration with both platforms allows you to optimize campaigns with A.I. and competitive intelligence insights.

Fulfillment and Shipping

What’s in the box? Your next order from one of these eCommerce giants.

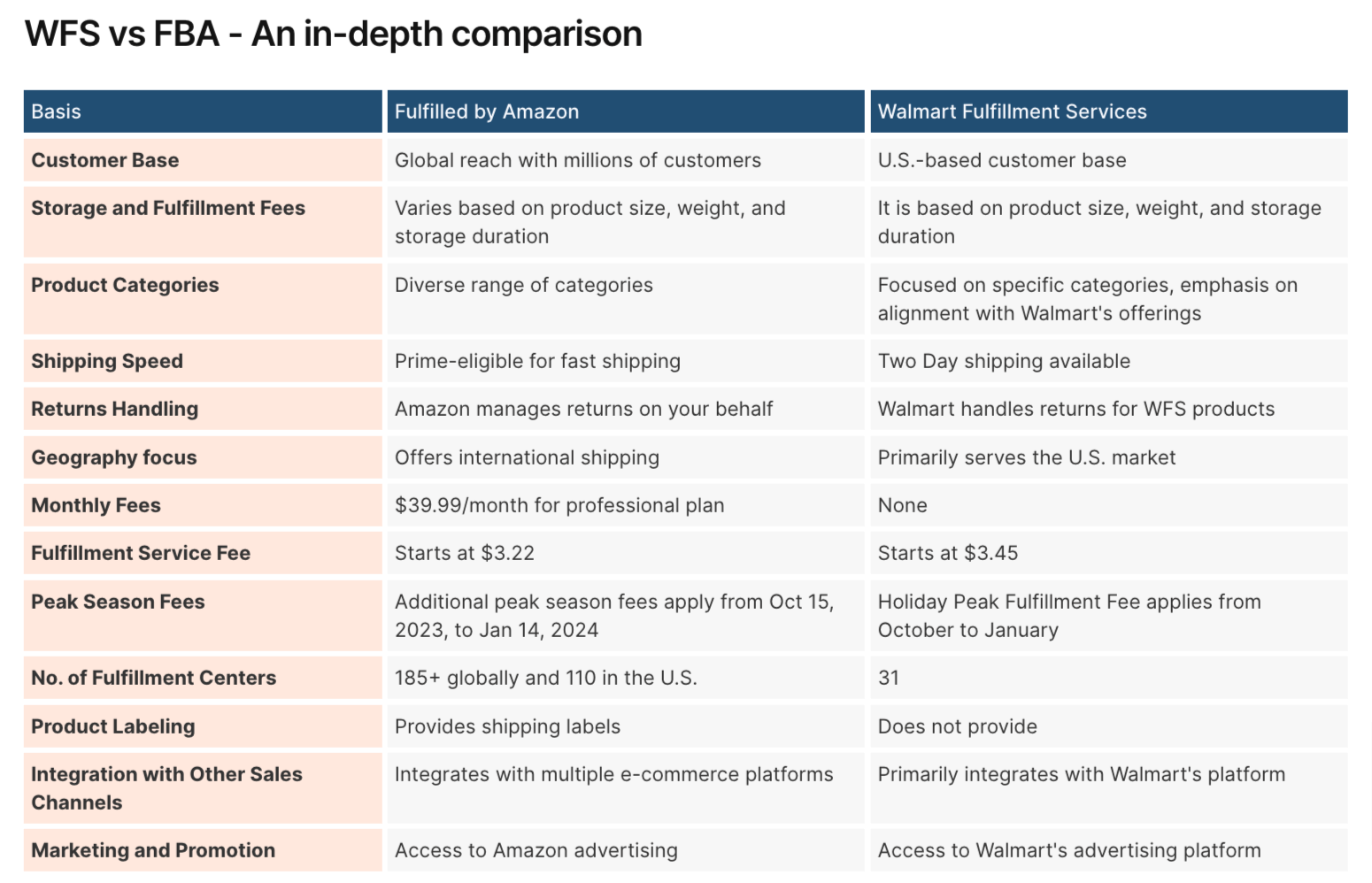

- Walmart Marketplace – Walmart offers two primary fulfillment options: Seller Fulfilled Warehouse (SFW) and Walmart Fulfillment Services (WFS). SFW allows you to manage your own inventory and fulfillment, while WFS leverages Walmart’s vast fulfillment network.

Thirty-one fulfillment centers and 4,700 stores are located within 10 miles of 90% of the U.S. population, leading to faster shipping times and potentially lower costs on high-volume items. The unique proximity advantage offered by this network increases customer pickups, eliminating some of the need for shipping.

- Amazon – Amazon offers Fulfillment by Amazon (FBA) as its primary fulfillment solution, allowing sellers to leverage its extensive network of 110 fulfillment centers in the U.S. (and 185 globally) for storage, picking, packing, shipping, and customer service. While FBA offers convenience and potentially faster shipping times, it comes at the cost of fulfillment fees.

Alternatively, Fulfilled by Merchant (FBM) sellers can manage their own fulfillment but may be at a disadvantage in shipping speed and eligibility for Prime benefits.

Verdict: Tie. Amazon has advantages that include lower seller costs and that FBA sellers gain access to the Prime badge, allowing them to access Prime customers and sale days. However, Walmart’s in-store pickup factor is unique and erases shipping costs and time. Both platforms offer robust and versatile fulfillment solutions, but the best choice depends on your business model, product type, volume, and profit margins.

Customer Service

Not only does high-quality customer service lead to repeat business and purchases, but it’s an essential metric in winning the Buy Box.

- Walmart Marketplace – Walmart provides basic seller support through its Seller Center platform. However, customer service inquiries are primarily handled by Walmart itself, which might limit your control over brand messaging.

- Amazon – Amazon offers a more robust seller support system, allowing you to manage some customer service interactions directly through Seller Central. This can give you more control over brand messaging and improve customer satisfaction.

Verdict: Amazon wins for offering more control over customer service interactions. However, Walmart’s approach can simplify your workload.

Returns and Refunds

Part of keeping customers happy—and getting good reviews—is making sure refunds and returns are simple for the occasional unsatisfied customer.

- Walmart Marketplace – Individual sellers set return policies on Walmart Marketplace, but Walmart does have some baseline requirements. Walmart offers a hassle-free return experience for Walmart+ members, which could potentially lead to higher return rates for sellers.

- Amazon – Amazon offers a standardized returns policy with various return windows depending on the product category. While this can simplify the returns process for both sellers and customers, it can also lead to higher return rates for sellers compared to a more customized policy.

Verdict: Tie. Both platforms have pros and cons regarding returns. The best approach depends on your product category and risk tolerance for return rates.

Who Wins in Walmart Marketplace vs. Amazon?

So, who reigns supreme in the battle of the eCommerce giants? The answer, like most things in business, depends. First, let’s review what we’ve already covered in a convenient chart:

| Category |

Walmart Marketplace |

Amazon | Tie |

| Overall Marketplace Revenue | ✔ | ||

| Marketplace Reach | ✔ | ||

| Ecommerce Share | ✔ | ||

| Less Competition | ✔ | ||

| Best for CPGs (Grocery Sales Advantage)

Best for SMEs |

✔ | ||

| Best for SMEs | ✔ | ||

| Best for Enterprise | ✔ | ||

| Seller Requirements | ✔ | ||

| Seller Fees | ✔ | ||

| Seller Command Center | ✔ | ||

| Membership Program | ✔ | ||

| Advertising and Branding Options | ✔ | ||

| Fulfillment and Shipping | ✔ | ||

| Customer Service | ✔ | ||

| Returns and Refunds | ✔ | ||

While Amazon has scored what appears to be a decisive victory, the reality of selling on each marketplace makes it much closer:

- For established digital brands with proven track records: Amazon might be the better initial choice due to its wider audience reach, established advertising solutions, and robust fulfillment options, especially for high-volume sellers

- For digital brands (and SMEs) seeking lower upfront costs and a potentially less competitive environment: Walmart Marketplace could be a strategic move. Their simpler fee structure and growing customer base offer an attractive opportunity for expansion.

However, the ideal scenario for most digital brands is a multichannel strategy that leverages the strengths of both platforms. This allows you to tap into the massive customer bases of both marketplaces, potentially reducing your reliance on any single platform.

Using Noogata, you can optimize your listings and advertising campaigns across both channels, maximizing your sales potential and brand visibility on the digital shelf.

Walmart Marketplace vs. Amazon: Win Both with Noogata

The battle between Walmart Marketplace and Amazon is a war of opportunity for digital brands. While Amazon boasts a broader audience reach and established eCommerce infrastructure, Walmart Marketplace offers a compelling alternative with its lower costs, growing customer base, and potential for high sales volume against less competition. Ultimately, the “winner” depends on your business goals and target audience.

The good news? You don’t have to pick just one. Adopting a multichannel strategy that leverages the strengths of both platforms expands your reach and sales potential.

This is where Noogata steps in as your secret weapon for eCommerce dominance. Integrating with both platforms, Noogata grows digital brands with invaluable AI-powered insights and competitive intelligence to optimize your product listings, boost winning ad campaigns, and take over the digital shelf.

Try a Noogata demo today to discover how your digital brand can outperform the Walmart Marketplace and Amazon competition.